It was good news on Thursday for regional bank First Republic, which on Monday was facing serious stress in the wake of the failure of Silicon Valley Bank. A coalition of larger banks agreed to funnel $30 billion in deposits to the bank to help it shore itself and meet the demand for withdrawals.

Major banks including JPMorgan Chase, Bank of America, Wells Fargo, Citigroup and U.S. Bank all came together to give a lifeline to First Republic Bank Thursday, and the Treasury Department said the gesture "demonstrates the resilience of the banking system" as a whole.

In a collective statement, the banks said, "This action by America’s largest banks reflects their confidence in First Republic and in banks of all sizes, and it demonstrates their overall commitment to helping banks serve their customers and communities. Regional, midsize and small banks are critical to the health and functioning of our financial system."

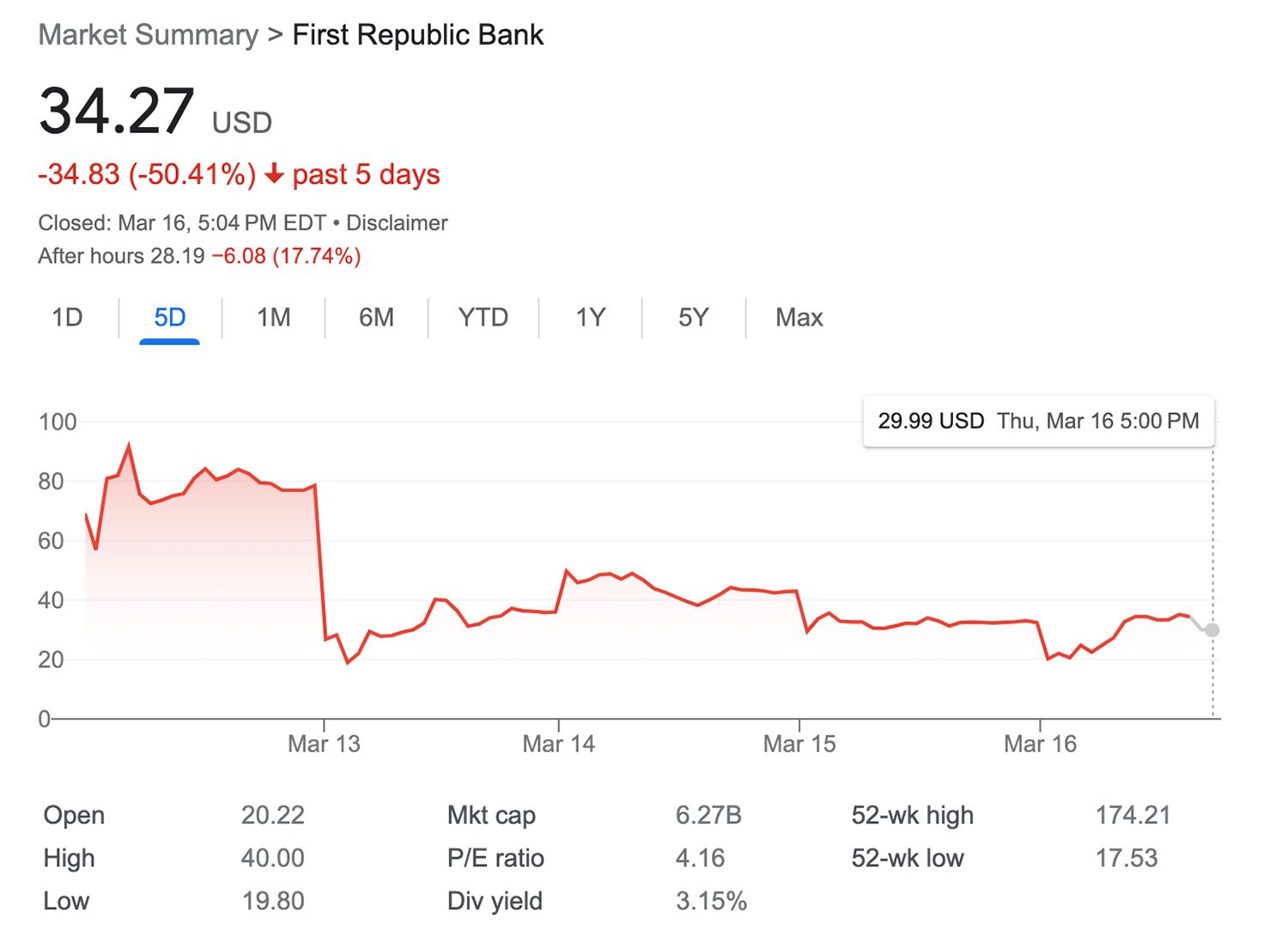

Trading in shares of First Republic have been halted multiple times this week due to volatility. After tanking by 70% early Monday, the bank's share price recovered considerably Tuesday, but it's had a rough week on Wall Street and remains down 50% overall in five days.

As CNN reports, S&P Global Ratings downgraded First Republic's credit rating this week based on its large number of uninsured deposits. Unlike SVB, which had 94% of its total deposits uninsured by the FDIC, First Republic has a lower percentage — but one that is still high at around 68%. This has led to a modest run on the bank with customers looking to move their money elsewhere this week.

First Republic is also said to have a particularly high liability to deposit ratio of 111%, meaning that it has lent out more money than it has to pay out to depositors, putting it in a high-risk position should borrowers default.

"America’s financial system is among the best in the world, and America’s banks – large, midsize and community banks – do an extraordinary job serving the banking needs of their unique customers and communities," the coalition of banks coming to the rescue today said. "The banking system has strong credit, plenty of liquidity, strong capital and strong profitability. Recent events did nothing to change this."

Previously: SF-Based First Republic Bank In Huge Trouble As Shares Collapse By More Than 70%, Trading Halted

Top image: An office sits empty at the First Republic Bank headquarters on March 16, 2023 in San Francisco, California. A week after Silicon Valley Bank and Signature Bank failed, First Republic Bank is considering a sale following a dramatic 60 percent drop in its stock price over the past week. The bank also received $70 billion in emergency loans from JP Morgan Chase and the Federal Reserve. (Photo by Justin Sullivan/Getty Images)